The cookie apocalypse is here: why auto dealers must act now

For years, automotive dealerships relied on third-party cookies to track website visitors, retarget car shoppers, and measure advertising performance across the digital ecosystem. That foundation is crumbling. With Google phasing out third-party cookies in Chrome, Apple’s Intelligent Tracking Prevention already blocking cross-site tracking in Safari, and privacy regulations tightening across North America and Europe, the playbook that powered dealership digital marketing for over a decade is becoming obsolete.

The stakes are enormous. The average car buyer spends 13 hours and 45 minutes researching online before stepping foot in a showroom. Without third-party cookies, dealerships lose visibility into much of that research journey. Retargeting pools shrink. Lookalike audiences become less precise. Attribution models break down. And the cost per lead climbs.

But here is the good news: dealerships that invest in first-party data strategies now will not only survive the transition, they will gain a significant competitive advantage. First-party data, the information customers share directly with your business, is more accurate, more durable, and more privacy-compliant than anything third-party cookies ever offered.

This guide walks you through a complete strategy for collecting, managing, and activating first-party data across your dealership’s marketing operations. Whether you run a single rooftop or a multi-location dealer group, these strategies will help you maintain, and even improve, your digital marketing performance.

Understanding first-party data in the automotive context

Before diving into strategy, it is important to understand what first-party data actually means for a dealership and how it compares to the data sources you may be losing.

Data types compared

| Data Type | Source | Examples (Automotive) | Post-Cookie Status |

|---|---|---|---|

| First-party data | Collected directly by your dealership | CRM records, website form submissions, service appointments, showroom visits, email engagement | Fully available, privacy-compliant |

| Second-party data | Shared by a trusted partner | OEM customer lists, co-marketing partner data, lender pre-approval lists | Available with proper agreements |

| Third-party data | Aggregated by external vendors | Cross-site browsing behavior, purchase intent signals from data brokers | Rapidly declining, blocked by browsers |

Dealerships actually sit on a goldmine of first-party data that most other industries envy. Think about it: every test drive request, every service appointment, every finance application, every trade-in appraisal generates rich, permission-based customer data. The challenge is not collecting it; it is organizing, connecting, and activating it effectively.

The automotive first-party data ecosystem

Your dealership likely collects data from these key touchpoints:

- Website interactions: Page views, VDP (Vehicle Detail Page) views, configurator usage, chat conversations, form submissions

- CRM records: Contact information, communication history, purchase timeline, lead source data

- DMS (Dealer Management System): Purchase history, service records, parts orders, warranty claims, financing details

- Showroom activity: Walk-in logs, test drive records, sales consultant notes

- Communication channels: Email opens and clicks, SMS responses, phone call records

- Loyalty programs: Rewards activity, referral data, satisfaction survey responses

The critical task is breaking down the silos between these systems to create a unified customer view that powers your marketing, and that starts with the right infrastructure.

Building a robust data collection infrastructure

A first-party data strategy is only as good as the infrastructure supporting it. For dealerships, this means connecting disparate systems and ensuring consistent data flows into a central platform.

Step 1: audit your current data landscape

Before building anything new, document what you already have:

- Identify all data sources: CRM, DMS, website analytics, ad platforms, call tracking, chat tools

- Map data fields: Which systems capture name, email, phone, vehicle interest, purchase stage?

- Assess data quality: How much duplication exists? Are records complete? How current is the data?

- Review consent records: Do you have documented opt-ins for marketing communications?

Step 2: establish a central data hub

Dealerships need a centralized system, often called a Customer Data Platform (CDP), where all customer data converges. For many dealers, this can be achieved by enhancing your existing CRM with proper integrations rather than purchasing an entirely new platform.

Key integration points include:

- CRM to DMS sync: Ensure sales and service data flow bidirectionally

- Website to CRM: Every form submission, chat conversation, and tracked interaction should create or update a CRM record

- Ad platforms to CRM: Connect Google Ads and Meta conversion data back to your customer records

- Call tracking to CRM: Attribute phone leads to their digital source

Proper tracking and reporting solutions are essential at this stage. Without accurate data collection and attribution, even the best first-party data strategy will produce unreliable insights.

Step 3: implement enhanced website tracking

Your dealership website is the single richest source of first-party behavioral data. To maximize its value:

- Deploy GA4 with enhanced measurement: Track scroll depth, file downloads, video engagement, and outbound clicks automatically

- Set up custom events: Track VDP views with vehicle attributes (make, model, year, price range), configurator completions, finance calculator usage, and trade-in tool submissions

- Implement user ID tracking: When a visitor logs in or submits a form, connect their anonymous browsing history to their known identity

- Use enhanced conversions: Share hashed first-party data with Google to improve conversion measurement accuracy

Customer consent strategies and privacy compliance

First-party data only works if customers trust you with their information. Transparent consent management is not just a legal requirement under GDPR, CCPA/CPRA, and Canada’s PIPEDA; it is a competitive differentiator.

Building a consent-first culture

- Implement a Consent Management Platform (CMP): Display clear, specific consent banners on your website that explain what data you collect and why

- Offer granular choices: Let users opt into marketing emails separately from service reminders, and both separately from analytics tracking

- Make value exchange clear: Explain what customers get in return for sharing data, such as personalized vehicle recommendations, priority service scheduling, or exclusive offers

- Document everything: Maintain audit trails of when and how each customer provided consent

Consent rates: what to expect

| Consent Approach | Typical Opt-In Rate | Data Quality |

|---|---|---|

| Generic Accept All banner | 40-55% | Low - many uninformed consents |

| Clear value proposition with granular options | 65-78% | High - informed, engaged users |

| Progressive profiling (ask gradually) | 70-85% | Highest - built over time with trust |

Dealerships that lead with a value exchange, for example, share your preferences to receive personalized inventory alerts when a vehicle matching your criteria arrives, consistently achieve opt-in rates above 70%. This approach yields a smaller but dramatically more valuable audience than blunt cookie-based tracking ever did.

Server-side tracking: the technical foundation

As browser-based tracking becomes increasingly restricted, server-side tracking has emerged as a critical component of any first-party data strategy. Instead of relying on JavaScript tags that browsers can block, server-side tracking sends data directly from your web server to analytics and advertising platforms.

Why server-side tracking matters for dealerships

- Accuracy: Server-side events are not blocked by ad blockers or browser privacy features, improving data completeness by 15-30%

- Speed: Removing client-side tags reduces page load time, improving user experience and SEO performance

- Control: You decide exactly what data is shared with each platform, maintaining full compliance

- Durability: Server-side integrations are not affected by browser policy changes

Implementation priorities

- Google Tag Manager Server-Side: Deploy a server-side GTM container to handle your core tracking tags

- Meta Conversions API (CAPI): Send purchase, lead, and engagement events directly to Meta for improved ad optimization

- Google Ads Enhanced Conversions: Share hashed customer data to improve conversion matching rates

- Offline conversion imports: Upload CRM data (showroom visits, test drives, purchases) back to ad platforms to close the attribution loop

Investing in robust tracking and reporting solutions that incorporate server-side capabilities ensures your data remains accurate regardless of how browser privacy policies evolve. This technical foundation directly supports the performance of your Google Ads campaigns and paid social campaigns.

Audience segmentation without third-party cookies

Third-party cookies made it easy to build large audiences based on browsing behavior across the web. Without them, dealerships need to build equally effective segments using their own data. The good news? First-party segments are actually more accurate, because they are based on real interactions with your business rather than inferred behavior.

High-value automotive segments to build

Purchase Funnel Segments:

- Research phase: Visitors viewing 3+ VDPs in a single session, using the configurator, or comparing models

- Consideration phase: Visitors who returned 2+ times within 14 days, viewed financing options, or checked trade-in values

- Decision phase: Form submitters, test drive schedulers, finance application starters

- Post-purchase: Recent buyers (0-6 months) for service upsell, accessories, and referral programs

Lifecycle Segments:

- Conquest targets: Service customers who did not purchase from you, indicating they own a competitor brand but trust your service department

- Loyalty pipeline: Customers approaching the typical 3-5 year replacement cycle based on their purchase date

- Service defectors: Customers who have not visited for service in 12+ months, at risk of leaving your ecosystem entirely

- Equity alert: Customers whose current vehicle has high trade-in value relative to their remaining loan balance

Activating segments across channels

Once built, these segments power your advertising across every platform:

- Google Customer Match: Upload hashed email lists to target and bid on high-intent segments in Search and YouTube campaigns. This is particularly powerful for Google Ads campaigns focused on model-specific conquest terms.

- Meta Custom Audiences: Use your CRM segments to build Custom Audiences and, critically, high-quality Lookalike Audiences that replace the precision lost from third-party data

- Dynamic inventory ads: Feed your first-party behavioral data into dynamic ads to show specific vehicles to shoppers who have already expressed interest in similar models

- Email personalization: Trigger automated email sequences based on where each customer sits in the buying cycle

Leveraging first-party data for Google Ads and Meta campaigns

The shift to first-party data does not mean your paid media performance has to suffer. In fact, dealerships that activate first-party data effectively in their ad campaigns often see improved ROAS because the signals they send to platforms are higher quality.

Google Ads first-party data playbook

- Enhanced conversions: Capture hashed email and phone data at conversion points and pass it to Google for better attribution

- Customer Match for bidding: Adjust bids higher for users who match your CRM’s high-value segments

- Offline conversion imports: Feed showroom visits, test drives, and actual vehicle sales back into Google Ads to optimize for real business outcomes, not just online leads

- Performance Max with audience signals: Use your first-party segments as audience signals in PMax campaigns to guide Google’s AI toward the right prospects

Meta (Facebook/Instagram) first-party data playbook

- Conversions API: Send server-side events for complete conversion tracking

- Custom Audiences from CRM: Build audiences from your service customer database for conquest campaigns

- Value-based Lookalikes: Create Lookalike Audiences seeded from customers with the highest lifetime value, not just any converter

- Catalog ads with retargeting: Use first-party website behavior to power dynamic ads showing specific inventory to interested shoppers

Your paid social campaigns will perform significantly better when fueled by first-party data because the audience signals are based on genuine customer interactions rather than probabilistic cookie-based inference.

Performance comparison: cookie-based vs. first-party data campaigns

| Metric | Cookie-Based Targeting (Legacy) | First-Party Data Targeting | Change |

|---|---|---|---|

| Cost per lead | USD 45-65 | USD 32-48 | -25 to -30% |

| Lead-to-appointment rate | 12-18% | 22-30% | +65-80% |

| Retargeting pool size | Large but decaying | Smaller but stable | Varies |

| Attribution accuracy | 55-65% | 80-92% | +35-45% |

| ROAS (Return on Ad Spend) | 4:1 - 6:1 | 6:1 - 9:1 | +50-65% |

These improvements are typical for dealerships that have fully implemented first-party data strategies. The smaller audience sizes are more than compensated for by the dramatic improvement in signal quality.

Predictive analytics: turning first-party data into foresight

Once you have a solid first-party data foundation, predictive analytics becomes your most powerful tool. By applying machine learning models to your historical customer data, you can anticipate customer behavior rather than simply reacting to it.

Predictive use cases for dealerships

- Purchase propensity scoring: Identify which leads are most likely to buy within 30, 60, or 90 days based on their digital behavior and CRM profile

- Vehicle preference prediction: Recommend specific models and trim levels based on browsing patterns, trade-in vehicle type, and financing preferences

- Service lifecycle prediction: Forecast when each customer will need their next service visit and proactively send reminders

- Churn prediction: Flag customers likely to defect to a competitor for service or their next purchase

- Optimal contact timing: Determine the best day and time to reach each customer based on their historical engagement patterns

Modern AI solutions can process your dealership’s historical CRM and DMS data to build these predictive models without requiring a data science team in-house. The key is having clean, connected first-party data to feed these systems.

AI-powered personalization in practice

Imagine a prospect visits your website and views three SUVs in the USD 40,000-50,000 range. With first-party data and AI-powered personalization:

- Their next website visit shows a personalized homepage featuring SUV inventory in their price range

- They receive an automated email highlighting a new SUV arrival matching their criteria

- Your Google Ads campaign bids more aggressively when they search for SUV-related terms

- Your paid social campaigns show them dynamic inventory ads featuring the exact SUVs they viewed, plus similar options

- When they call or visit, your sales team has their complete digital journey in the CRM, enabling a personalized conversation

This level of orchestration was impossible with third-party cookies alone. It requires first-party data, and it delivers dramatically better results.

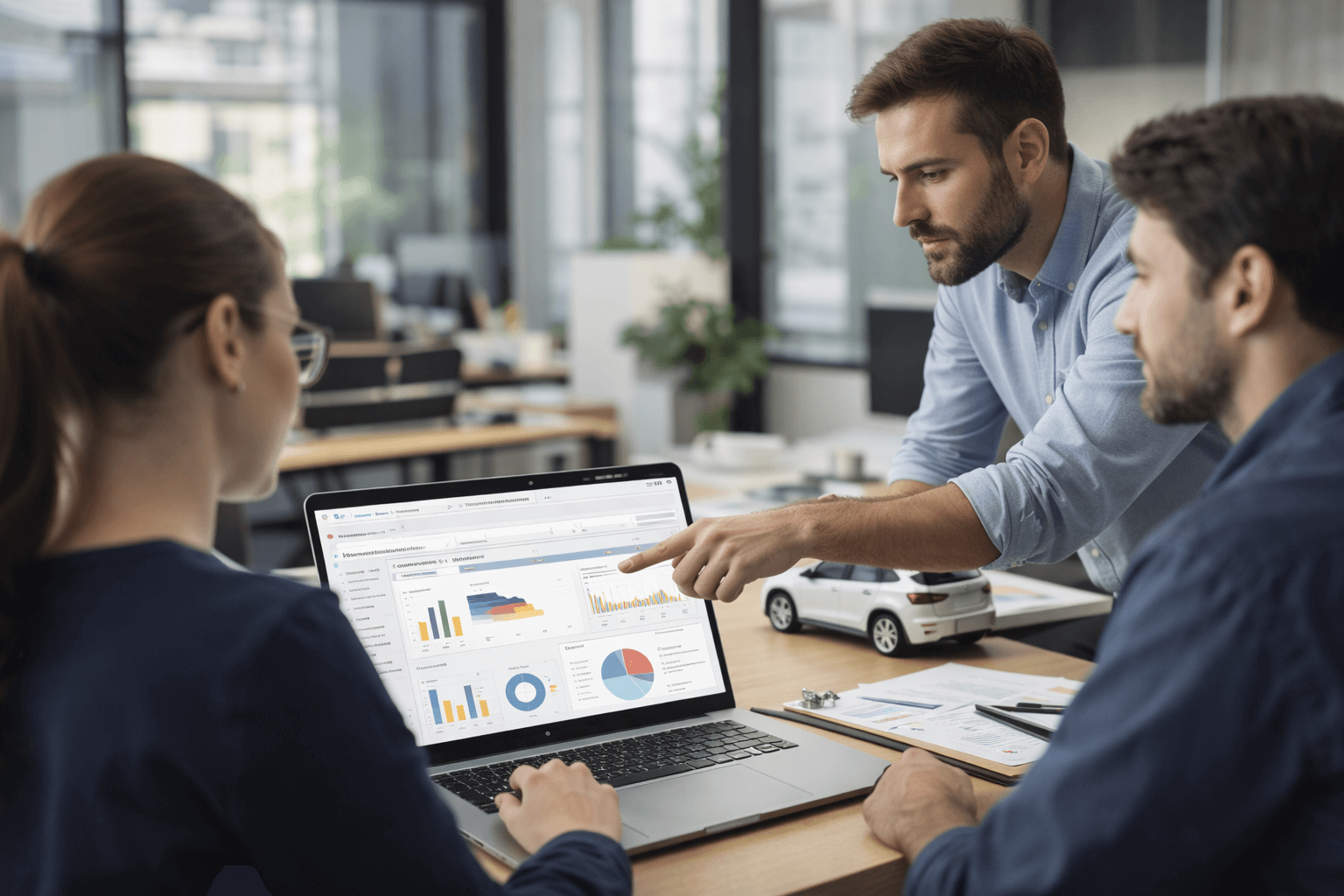

Real-world results: a multi-location dealer group case study

A regional dealer group operating 8 locations across two provinces implemented a comprehensive first-party data strategy over 12 months. Here is what they did and what happened.

The challenge

- Declining retargeting performance: Cookie-based retargeting audiences had shrunk by 35% over 18 months

- Rising cost per lead: CPL had increased 28% year-over-year with no improvement in lead quality

- Fragmented data: CRM, DMS, website analytics, and ad platforms operated in complete silos

- Attribution gaps: Only 45% of actual vehicle sales could be attributed to a specific marketing channel

The strategy

- Unified data infrastructure: Connected CRM and DMS data to a central platform with proper identity resolution

- Server-side tracking: Deployed GTM server-side containers across all 8 dealership websites

- Consent optimization: Redesigned consent flows with clear value propositions, achieving 74% opt-in rates

- First-party audience activation: Built 12 custom audience segments and activated them across Google Ads, Meta, and email

- Offline conversion loop: Automated weekly uploads of showroom visits, test drives, and sales data to Google and Meta

- Predictive lead scoring: Implemented AI-driven scoring to prioritize follow-up on the highest-propensity leads

The results (after 12 months)

| Metric | Before | After | Improvement |

|---|---|---|---|

| Cost per qualified lead | USD 58 | USD 39 | -33% |

| Lead-to-sale conversion rate | 8.2% | 13.7% | +67% |

| Marketing-attributed sales | 45% | 84% | +87% |

| Email engagement rate | 12% open / 1.8% click | 34% open / 5.2% click | +183% / +189% |

| Service retention rate | 41% | 58% | +41% |

| Overall marketing ROI | 5.2:1 | 8.8:1 | +69% |

The most significant insight was not just the performance improvement but the compounding effect: better data led to better targeting, which led to more conversions, which generated more first-party data, which further improved targeting. This virtuous cycle is the true power of a first-party data strategy.

Your first-party data action plan: getting started

Transitioning to a first-party data strategy does not require a complete overhaul overnight. Here is a phased action plan that any dealership can follow.

Phase 1: foundation (months 1-2)

- Audit your current data: Catalog every data source, assess quality, identify gaps

- Implement GA4 properly: Ensure enhanced measurement is active and custom events are tracking VDP views, form submissions, and key interactions

- Deploy a CMP: Set up a consent management platform with clear value propositions

- Connect CRM and website: Ensure every website lead flows into your CRM with source attribution

- Review your SEO strategy: Organic traffic generates high-quality first-party data at zero media cost; invest in visibility

Phase 2: activation (months 3-4)

- Build first-party audiences: Create your initial segments based on CRM data and website behavior

- Launch Customer Match campaigns: Upload your segments to Google Ads and Meta

- Implement enhanced conversions: Enable hashed data sharing for better attribution

- Set up offline conversion imports: Begin feeding showroom and sales data back to ad platforms

- Optimize your Google Ads campaigns to leverage first-party audience signals

Phase 3: optimization (months 5-6)

- Deploy server-side tracking: Move your most important tags to a server-side GTM container

- Implement Meta Conversions API: Ensure complete conversion data flows to Meta

- Launch predictive scoring: Use AI solutions to prioritize leads and personalize outreach

- Test dynamic inventory ads: Activate dynamic ads powered by first-party behavioral data

- Measure and iterate: Compare performance against your pre-implementation baselines and refine

Phase 4: scale (months 7-12)

- Expand to all locations: Roll out proven strategies across your dealer group

- Advanced personalization: Implement AI-driven website and email personalization

- Predictive lifecycle marketing: Automate campaigns triggered by predicted customer behavior

- Second-party data partnerships: Explore data sharing with OEMs and trusted partners

- Continuous optimization: Regularly refresh segments, test new audiences, and refine predictive models

The bottom line: first-party data is your dealership’s future

The end of third-party cookies is not a crisis for auto dealerships; it is an opportunity. Dealerships that embrace first-party data strategies will build deeper customer relationships, achieve better marketing performance, and create a sustainable competitive moat that cookie-dependent competitors cannot replicate.

The data you need already exists in your CRM, your DMS, your website, and your showroom. The challenge is connecting it, activating it, and continuously refining it. Dealerships that start now will compound their advantage every month, while those that wait will find it increasingly difficult, and expensive, to catch up.

The automotive industry has always been relationship-driven. First-party data simply brings that relationship-first philosophy into the digital realm, where 87% of your customers begin their buying journey.

Ready to build your first-party data strategy? Contact MyDigipal’s automotive team to discuss how we can help your dealership thrive in a cookieless world. Or estimate your investment with our quick budget tool.