First-party data strategies for automotive dealerships post-cookie era

The automotive retail landscape is undergoing a seismic shift. With third-party cookies crumbling and privacy regulations tightening, dealerships can no longer rely on traditional digital tracking methods to understand and engage their customers. The solution? A robust first-party data strategy that puts you in direct control of your customer relationships.

For automotive dealerships, this transition isn’t just a challenge—it’s an unprecedented opportunity to build deeper, more meaningful connections with car buyers while maintaining compliance with evolving privacy standards. This comprehensive guide will walk you through practical strategies for collecting, managing, and activating first-party data across every customer touchpoint.

Understanding first-party data in the automotive context

First-party data is information that your dealership collects directly from customers through owned channels—your website, showroom visits, service appointments, test drives, and direct communications. Unlike third-party cookies that track users across the web, first-party data comes with explicit customer consent and provides more accurate, reliable insights into buyer behavior.

For automotive dealerships, first-party data includes:

- Website behavior and vehicle configuration preferences

- Service history and maintenance records

- Trade-in valuations and financing inquiries

- Test drive requests and showroom appointments

- Email engagement and communication preferences

- Customer demographics and household information

- Purchase history and ownership lifecycle stage

This data goldmine already exists within your dealership’s ecosystem. The key is systematically collecting, organizing, and activating it to drive sales and service retention.

Building your data collection foundation

Website optimization for data capture

Your dealership website is the primary digital touchpoint where potential customers begin their journey. Every interaction represents an opportunity to collect valuable first-party data—but only if you’ve built the right infrastructure.

Start by implementing progressive profiling techniques. Instead of bombarding visitors with lengthy forms that kill conversion rates, gather information incrementally across multiple interactions. When someone first expresses interest in a vehicle, ask only for essential information like name and email. As they return and engage further—configuring vehicles, scheduling test drives, or requesting quotes—collect additional details like phone number, trade-in information, and preferred contact methods.

Consider implementing these high-converting data capture points:

Interactive Vehicle Configurators: When customers build their ideal vehicle online, you’re collecting powerful intent data. Track which models, trim levels, colors, and features they select. This information reveals not just what they’re interested in, but their budget range and priorities.

Value Assessment Tools: Trade-in estimators and payment calculators require users to input specific information about their current vehicle and financial situation. This data helps you understand their timeline and purchasing power before the first conversation.

Appointment Scheduling Systems: Integrated booking tools for test drives, service appointments, and sales consultations capture contact information while demonstrating your commitment to convenience.

Gated Premium Content: Offer valuable resources like buying guides, model comparison sheets, or maintenance schedules in exchange for email addresses. This positions your dealership as a trusted advisor while building your contact database.

Maximizing physical touchpoint data collection

The showroom floor and service drive remain critical data collection environments. Every customer interaction in your physical location should feed into your first-party data ecosystem.

Train your sales and service teams to capture comprehensive information during every interaction. When a customer visits for a test drive, don’t just record their name and the vehicle they drove—document their reactions, concerns, questions, and specific features that excited them. This qualitative data enriches your CRM and enables personalized follow-up.

Implement digital check-in systems for service appointments that allow customers to update their contact information, communication preferences, and household changes. Many customers who purchased vehicles years ago have new email addresses, phone numbers, or even additional household drivers—information that’s invaluable for marketing and retention efforts.

Consider deploying tablets in waiting areas where customers can voluntarily provide additional information in exchange for benefits like service discounts, exclusive offers, or entry into vehicle giveaways. Make the value exchange clear and compelling.

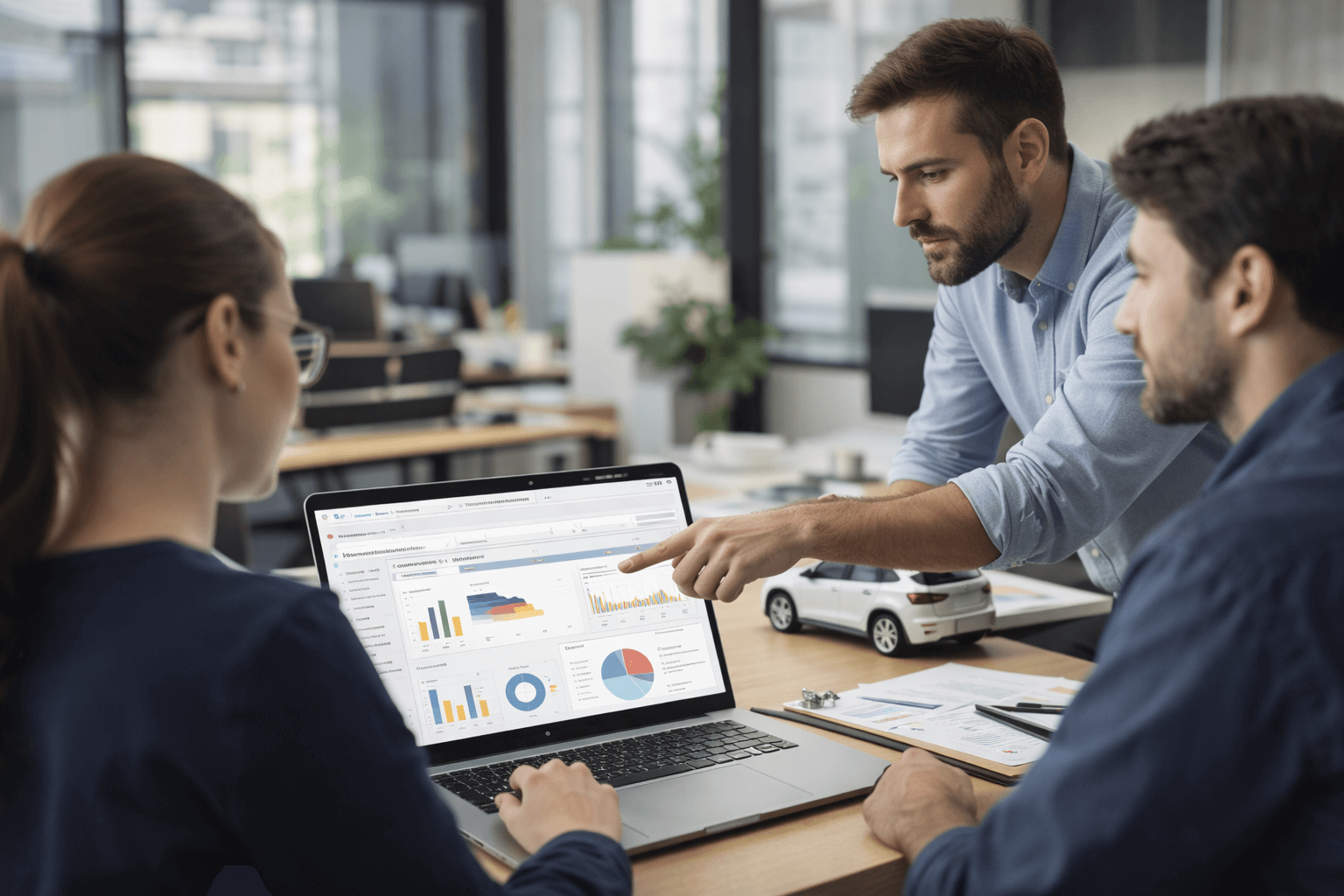

CRM integration and data unification

The most sophisticated data collection efforts fail if information remains siloed across disconnected systems. Automotive dealerships typically operate with multiple platforms—website analytics, CRM systems, Dealer Management Systems (DMS), email marketing tools, and service scheduling software. True first-party data power comes from unifying these sources into a single customer view.

Connecting your DMS with customer data platforms

Your DMS contains transactional data—sales, service visits, parts purchases, and financial arrangements. However, most legacy DMS platforms weren’t designed for modern marketing automation or customer journey orchestration. The solution is implementing middleware or Customer Data Platforms (CDPs) that bridge your DMS with marketing and communication tools.

This integration enables powerful capabilities:

Automated Lifecycle Marketing: When your DMS records a vehicle sale, your marketing automation can trigger a welcome series, schedule service reminders based on mileage and time, and initiate equity mining campaigns as the vehicle ages.

Service-to-Sales Conversion: Service customers with aging vehicles represent prime sales opportunities. By connecting service records with CRM data, you can identify customers whose vehicles are reaching the end of their useful life and proactively reach out with trade-in offers and new vehicle information.

Household-Level Intelligence: Many customers in your database have multiple household members who also drive and purchase vehicles. Unified data systems help you identify these relationships and market appropriately to the entire household rather than treating each person as an isolated contact.

Data hygiene and enrichment practices

First-party data is only valuable when it’s accurate and current. Implement regular data hygiene protocols:

Establish quarterly data cleansing campaigns where you verify contact information, remove duplicates, and update outdated records. Use email verification services to identify invalid addresses before they damage your sender reputation.

Implement validation rules at the point of collection. Require properly formatted phone numbers and email addresses, use address verification APIs to ensure accurate mailing information, and include confirmation steps for critical data points.

Enrich your first-party data with publicly available information. When a customer provides their email address, you can often append additional demographic and household data from reputable data providers—without relying on third-party cookies. This enrichment helps with segmentation and personalization while maintaining privacy compliance.

Lead nurturing without third-party cookies

The post-cookie era requires reimagining how you nurture leads from initial interest through purchase and beyond. Without the ability to retarget website visitors across the internet, your strategy must focus on owned channels and permission-based communication.

Email marketing as your primary nurture channel

Email remains the most powerful owned channel for automotive dealerships. With proper first-party data collection, you can build sophisticated email nurture programs that guide prospects through their buying journey.

Develop segmented nurture tracks based on customer behavior and stated preferences:

Active Shoppers: Prospects who’ve configured vehicles, requested quotes, or scheduled test drives receive frequent, relevant communications highlighting the specific models they’ve shown interest in, available incentives, and inventory updates.

Research-Phase Buyers: Earlier-stage prospects receive educational content about vehicle comparisons, financing options, and ownership costs. The goal is positioning your dealership as a trusted resource while keeping your brand top-of-mind.

Service-to-Sales Prospects: Existing customers with aging vehicles receive communications focused on trade-in value, new model features, and upgrade incentives. These messages reference their current vehicle and service history, demonstrating your relationship and knowledge.

Loyalty and Retention: Recent buyers receive ownership tips, service reminders, and exclusive owner benefits that strengthen the relationship and increase lifetime value.

Personalize every message using the first-party data you’ve collected. Reference specific vehicles they’ve viewed, acknowledge their trade-in, mention their preferred contact times, and tailor offers based on their indicated budget range.

SMS and messaging strategies

Text messaging has become an expected communication channel in automotive retail. With proper opt-in collection, SMS provides immediate, high-engagement touchpoints throughout the customer journey.

Collect SMS consent separately from email, clearly communicating the types of messages customers will receive and frequency expectations. Use SMS for time-sensitive communications like appointment reminders, service completion notifications, and limited-time offers on vehicles customers have expressed interest in.

Implement conversational messaging that allows customers to respond with questions, schedule appointments, or request information. This two-way communication generates additional first-party data about customer preferences and concerns while providing the immediate responsiveness modern consumers expect.

Privacy, consent, and compliance

Building a first-party data strategy requires unwavering commitment to privacy and transparent data practices. The regulations driving the death of third-party cookies—GDPR, CCPA, and emerging state privacy laws—also govern first-party data collection and use.

Transparent consent management

Implement clear, conspicuous consent mechanisms at every data collection point. Your website privacy policy should be easily accessible and written in plain language that explains what data you collect, how you use it, and who you share it with.

Use progressive consent strategies that request permissions when they’re relevant. When someone subscribes to your email list, that’s the moment to explain your email practices and request consent. When they schedule a test drive, explain how you’ll use their phone number and driving preferences.

Provide easy opt-out mechanisms and honor them immediately. Include unsubscribe links in every marketing email, offer preference centers where customers can choose which communications they receive, and maintain do-not-contact lists across all channels.

Data security and access controls

First-party data represents both a valuable asset and a significant liability. Implement robust security measures to protect customer information from breaches that could damage trust and trigger regulatory penalties.

Encrypt sensitive data both in transit and at rest. Implement role-based access controls ensuring employees can only access customer information necessary for their job functions. Conduct regular security audits and penetration testing to identify vulnerabilities.

Establish data retention policies that balance marketing needs with privacy principles. You don’t need to keep every piece of customer data indefinitely—develop protocols for archiving or deleting information after it’s no longer useful or required for regulatory compliance.

Measuring success and optimizing your strategy

A first-party data strategy isn’t a set-it-and-forget-it initiative. Continuous measurement and optimization ensure you’re maximizing the value of your data assets while respecting customer privacy.

Key Performance indicators

Track metrics that demonstrate the business impact of your first-party data initiatives:

Data Collection Rate: Monitor what percentage of website visitors and showroom guests provide contact information. Test different value propositions and collection methods to improve this baseline metric.

Data Completeness: Measure how much information you have for each contact. Contacts with complete profiles—including vehicle preferences, trade-in information, and communication preferences—are more valuable than those with just an email address.

Engagement Rates: Track email open rates, click-through rates, and SMS response rates across different segments. Higher engagement indicates your personalization and targeting strategies are resonating.

Conversion Metrics: Ultimately, first-party data should drive sales and service revenue. Measure lead-to-sale conversion rates, service retention rates, and customer lifetime value for contacts in your first-party data ecosystem versus those outside it.

Data Decay Rate: Contact information becomes outdated over time. Monitor what percentage of your database has invalid email addresses or phone numbers, and track how your data hygiene efforts improve this metric.

Taking action: your first-party data roadmap

Transitioning to a first-party data strategy might seem overwhelming, but you can implement it systematically through a phased approach.

Phase 1: Audit and Foundation (Weeks 1-4) Inventory all current data collection points and systems. Identify gaps where valuable data isn’t being captured. Review your privacy policies and consent mechanisms for compliance. Establish your data governance framework and security protocols.

Phase 2: Integration and Unification (Weeks 5-12) Connect your DMS, CRM, website, and marketing tools to create unified customer profiles. Implement a CDP or middleware solution if needed. Establish data flow processes ensuring information collected at any touchpoint enriches the central customer record.

Phase 3: Optimization and Activation (Weeks 13-24) Enhance website data collection with interactive tools and progressive profiling. Develop segmented nurture campaigns using your first-party data. Train staff on data collection best practices. Launch personalization initiatives across email, SMS, and web channels.

Phase 4: Measurement and Refinement (Ongoing) Continuously monitor KPIs, test optimization hypotheses, and refine your approach based on results. Stay current with privacy regulations and adjust practices as needed.

Conclusion

The deprecation of third-party cookies isn’t the end of digital marketing for automotive dealerships—it’s the beginning of a more sustainable, privacy-respecting approach built on direct customer relationships. First-party data strategies deliver more accurate insights, higher engagement, and stronger customer loyalty than third-party tracking ever could.

By systematically collecting data across your website, showroom, and service drive, unifying it in your CRM ecosystem, and activating it through personalized nurture campaigns, you’ll build a marketing engine that doesn’t just survive the post-cookie era—it thrives in it.

The dealerships that invest in first-party data infrastructure today will dominate their markets tomorrow. The question isn’t whether to build this capability, but how quickly you can implement it before your competitors do.

Ready to transform your dealership’s data strategy? Contact MyDigipal today to schedule a consultation and discover how our platform can accelerate your first-party data journey.